In the months leading up to February 24, 2022, as Russian tanks and troops accumulated around the Ukrainian border, several European capitals remained skeptical that a full-scale war was likely. Nevertheless, almost from the moment Russian missiles began landing on Ukrainian cities, the Western world demonstrated an unprecedented willingness to economically isolate an integrated member of the global trading system. In her new book, “Punishing Putin,” Bloomberg journalist Stephanie Baker tells the inside story of why and how the response to Russian aggression in 2022 differed so significantly from the international response of 2014 — and explains why economic coercion has not been enough to stop Russia’s war machine.

Hundreds of major Western companies have ceased operations in Russia, hundreds of billions of dollars worth of Moscow’s assets have been seized, restrictions have been placed on the export of critical technologies to the country — and yet, Russia’s war against Ukraine continues with no clear end in sight. Do sanctions work?

STEPHANIE BAKER: It’s impossible to prove a counterfactual, but I don’t think there’s any doubt that the Russian economy and the Russian military-industrial complex would be in better shape today if there hadn’t been such a strong international effort to impose sanctions. No one wanted to go to war with a nuclear power, and so the response leaned heavily on economic tools. The sanctions have cost Russia hundreds of billions of dollars, so the economic war hasn’t been a total failure, but it hasn’t been enough to force a withdrawal of Russian troops from Ukraine. That’s partly because Putin doesn’t appear to care about the health of the Russian economy. The sanctions are now geared towards bleeding Russia of the resources to keep the war going. More than two years on, Russia has burned through a large portion of its stockpiles of weapons and tanks, but Putin has put the economy on a wartime footing, with defense factories working around the clock.

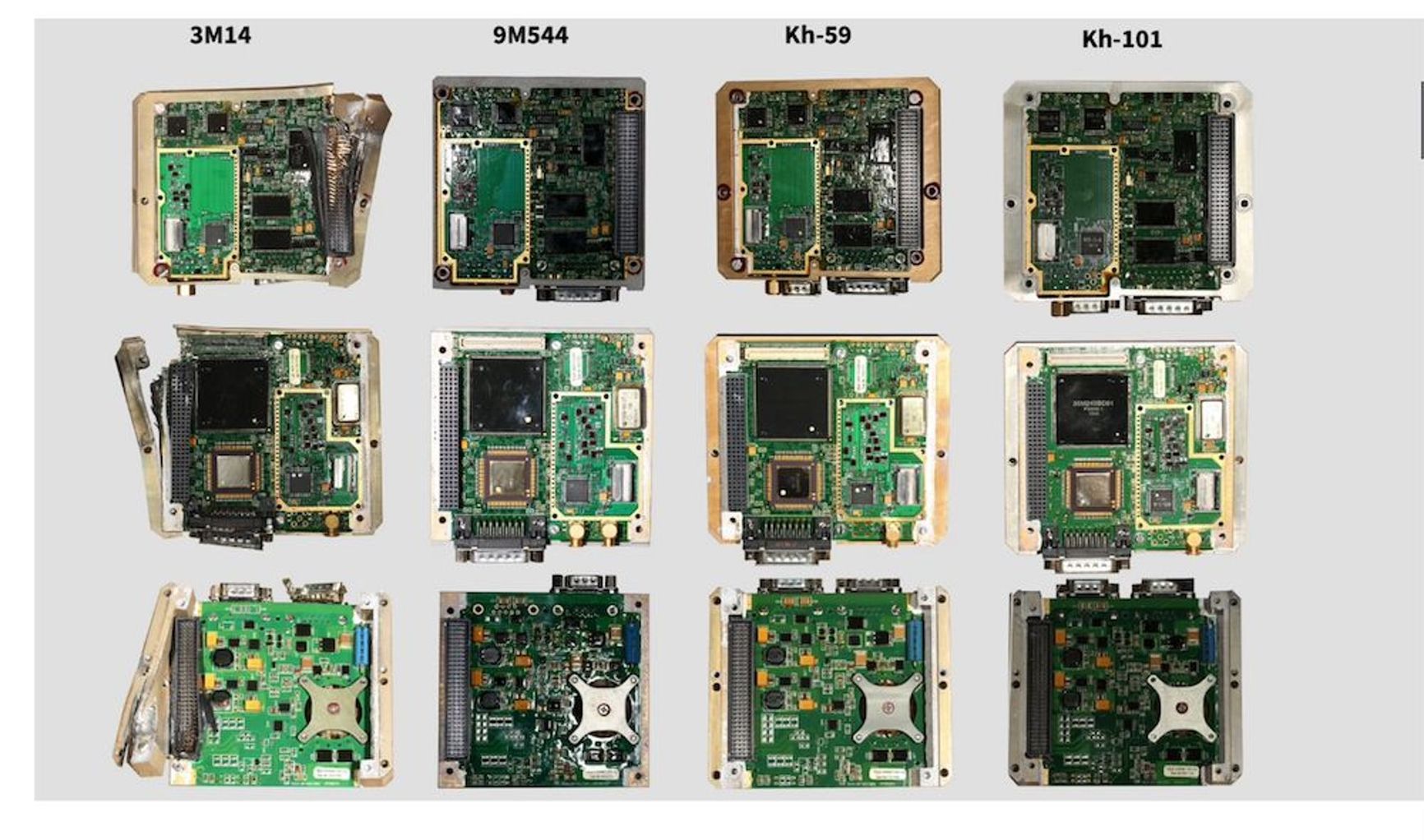

Russia has managed to keep churning out missiles and artillery but not without significant headwinds. Reports suggest Russia is paying more than it otherwise would — in some cases much more — for the components it uses to make missiles and other precision-guided weapons, and that’s because of the friction that sanctions and trade restrictions have introduced. There’s no reason Russia would be turning to Iran and North Korea for missiles if it were able to make enough on its own. The reliance of the Russian military on Western technology is something I don’t think we had a good grasp of before the war, but the Ukrainians have recovered so many components on the battlefield that it’s helped us better understand what Russia needs. The problem has been weak enforcement of export controls, which has allowed Russia to import millions of semiconductors through places like China and Hong Kong. Hundreds of billions of dollars of Russian money has been frozen, both sovereign and private assets. But I think oil is still the central challenge facing the sanctions coalition. The West allowed Russia to recover from the unprecedented sanctions on the back of oil revenues.

Why weren’t sanctions on Russian energy exports stronger to begin with, and what can we do to lower Russian oil revenues going forward?

Oil has been the mainstay of the Russian economy going back to Soviet times, and until we can find a way to drive Russia’s oil revenues down, it’s going to be very difficult to undermine Putin’s ability to finance the war. In the run-up to February 2022, the Biden administration understood that energy was going to be our Achilles heel here in the West if he launched a full-scale invasion. Energy is where Russia has leverage over the West. Right after the invasion, European leaders rolled out sanctions against Russia, but they held back from touching energy. Then Bucha happened, and that’s really when European leaders became prepared to think the unthinkable — which was to propose the embargo on Russian oil, including the banning of European shipping services.

When Bucha happened, European leaders became prepared to think the unthinkable — the embargo on Russian oil

But the looming embargo had the Biden administration panicking, because they were afraid it would cause a spike in gasoline prices just months before crucial midterm elections. That’s when they developed the idea of the price cap on Russian oil. The big mistake there was, due to all of the horse trading in Brussels, they did not set the price cap low enough and landed on $60 a barrel. The Poles were pushing for a much lower price cap, as were the Ukrainians, but countries like Hungary and Greece were pushing back. As part of the compromise, the EU agreed that they’d go back and review the level of the cap periodically, but there hasn’t been the political will to lower it. They could have allowed the European Commission to decide how to set the price, which would have made it more flexible.

In 2022, Russia purchased more than 100 tankers for the “shadow fleet” through anonymous intermediary companies

Russia has infamously been using a “shadow fleet” of tankers to sell its oil abroad at prices above $60 per barrel. Can we stop it somehow?

One of the crucial mistakes that the G7 [Group of Seven advanced democracies] made was not preventing Russia from assembling the shadow fleet. U.S. Treasury officials told me beforehand that they knew this was going to happen. But the EU made a mistake by not preventing the Greeks from selling old tankers. The price cap worked for a few months before the shadow fleet got up and running, and then India started buying huge volumes of Russian oil. Officials knew that would happen to some extent; they were counting on the price cap allowing countries like India to bargain down the price they paid for Russian oil, and the Indians did that, but no one thought India would buy as much Russian oil as they’ve ended up buying. They’re even refining it and selling it on to Europe. The G7 should be blacklisting more of the shadow fleet and the UK has recently done that, which is great. It ought to be doing more to prevent sanctioned tankers from unloading in ports in India, using the threat of secondary sanctions, but so far, no action has been taken.

Why haven’t we taken those steps?

There’s an unwillingness in the West to bear the costs of an all-out economic war against Russia — because it does mean higher energy prices, and it does mean increasing restrictions on trade with third countries, particularly with former Soviet states that are re-exporting goods to Russia in violation of sanctions and export controls. There are a lot of parallel imports getting through — everything from cars to iPhones to Coca-Cola. Leaks in the sanctions campaign need to be plugged. Showing a willingness to sanction a Chinese bank for doing business with Russian entities could have a huge overall impact and scare all the other Chinese banks to stop doing business with Russia. Doing something like that wouldn’t just slow down the flow of goods to Russia — it could potentially drive a wedge between the ‘no limits’ partnership between Russia and China. Given its softening economy, China needs to be able to trade with the world more than it needs to be able to trade with Russia. If it’s done right, disrupting that relationship could be very effective. But I think there’s a reluctance to add to the already difficult relations with Beijing.

Experts found that microchips and microcontrollers in the guidance unit of the 9M544 guided rocket for the Tornado-S MLRS are available for order on AliExpress

Conflict Armament Research

How important are the middlemen who help Russia obtain sanctioned goods? Do we have the capacity to prevent private actors and third countries from operating as accomplices to Russian sanctions evasion?

In terms of affecting Putin’s actual ability to wage war, it’s important that we go after the intermediaries who are facilitating the flow of sanctioned components into Russia. The U.S. Justice Department has issued incredibly detailed indictments in order to expose these networks, so that people can have a better understanding of how they operate, so that unwitting participants can be a bit more savvy. Shutting down middlemen will make it more costly for Russia. But it’s limited by the amount of resources that the Justice Department has available, and prosecutors tend to only take shots when they know they have a winning case. I write about one instance in which a middleman in the U.S. was in direct communication with an FSB Colonel, but it’s rare that law enforcement actually finds a direct link going back to the FSB. And even in successful cases, it’s like playing Whack-a-Mole. When you shut down one intermediary, another just pops right back up. The problem is that most of them are operating out of Hong Kong, China, and India, outside the reach of US law enforcement.

Is it possible to stop the flow of goods to Russia on a different level? Would we be better off focusing enforcement efforts towards the manufacturers of sanctioned products, rather than on the distributors?

When it comes to the flow of microelectronics to Russia, I think we need to start holding semiconductor companies and their authorized distributors accountable if we’re really going to bring about a change. Going after middlemen only gets you so far. These big semiconductor companies say they aren’t trading with Russia — and it’s true. I’ve looked at Russian customs data quite extensively, and these companies are not trading directly with Russia. But I can see how their products are getting into Russia nevertheless, and these companies should be able to trace this business fairly easily. They’re certainly more sophisticated than I am at going through these huge data sets and can ask distributors where they’ve sold on to. I think they need to have a much better handle on their supply chains globally. Neither the Justice Department nor the Commerce Department has taken any action against the companies. I don’t think it’s impossible for these companies to change the way they do business. They ought to be able to invest in compliance, just like banks have invested massively over the past 25 years to trace money flows.

We need to start holding semiconductor companies and their authorized distributors accountable if we’re really going to bring about a change

The U.S. has banned Russia from importing a broad class of components if they’re produced with U.S. software or U.S. machinery or U.S. design — even if they’re produced and shipped from China directly. The problem is, how do you enforce that? Semiconductors and microprocessors have highly globalized supply chains, and many countries are not signed up to the export control coalition. So to enforce this, the U.S. has leaned on banks to urge them to shut down this trade. In December, the Biden administration threatened to impose sanctions on banks that do business with entities from Russia’s military-industrial complex. In June, they widened that. And that has scared a lot of Chinese banks away from that business. They don’t want to be cut off from the U.S. dollar for the sake of what is, globally, a very small market in Russia. The U.S. imposed sanctions on a Chinese bank over Iran during the Obama administration. It could do the same with a Chinese bank over financial links to Russia.

What about seizing assets from oligarchs? At the start of the full-scale war, it seemed like a lot of attention was devoted to yachts and other high-end personal property. Are those efforts ongoing? Are they effective?

Going after the luxury assets, like the yachts, was an attempt to expose corruption at high levels, to show Russians that they were getting ripped off. It was also a symbolic move to demonstrate that sanctions would be properly enforced from here on out. Early on, there were even high hopes that it would be a way to seize Russian assets that could be forfeited for the benefit of Ukraine — to get some cold hard cash for Ukraine through these enforcement actions. But we’ve seen the difficulty of doing that when faced with Russia’s sophisticated use of shell companies, and propensity for doing opaque deals. The U.S. Justice Department is still fighting a Russian billionaire who is challenging the seizure of the superyacht Amadea, which I describe in my book, and the problem with that one is it’s actually costing the U.S. government money, because there is a legal obligation to maintain the yacht while the legal fight drags on.

The Amadea, a yacht allegedly linked to Suleiman Kerimov

We focus a lot of Western efforts to make Russia pay, but of course, Russian officials are presumably working just as hard to counteract our actions. How well do the people we’re targeting understand the Western financial system, and how successfully have they adapted to all of these new restrictions?

I think the Russians have an incredibly sophisticated understanding of global financial networks and how to use offshore centers to hold their assets. There’s no one better at this game than they are. But a lot of the British overseas territories that Russians were using are required to enforce the UK sanctions, so that has pushed a lot of Russians into offshore centers further afield. You see the shadow fleet of oil tankers using places like Gabon and Cameroon. The Seychelles is also being used more frequently. The sanctions have been a boost to jurisdictions beyond traditional offshore centers, because the economic war has shrunk the space where Russians are able to move freely. Having said that, I am still seeing evidence that British overseas territories are being used for sanctions evasion using opaque trust structures.

On a more macro level, how did the Russian economy manage to cope with the sanctions regime to the extent that it has?

There were signs that Putin was preparing for the war for quite a while. First, there was a surge in imports of Western components in late 2021, and it looks like Russia’s defense industry was stockpiling semiconductors and microelectronics in anticipation of Western restrictions. Russia had also built up a war chest of central bank reserves to be able to manage the value of the ruble. But Putin left about $300 billion of those reserves in G7 countries. That left Russia vulnerable to a financial attack. The G7 immobilized those reserves within days of Putin’s full-scale invasion, taking Putin by surprise. Russia had dramatically pared back its dollar holdings and expanded its holdings of euros in the preceding years in what now looks like a calculated strategy to minimize the impact of any U.S. sanctions. About 190 billion euros was caught in Euroclear, a clearing house in Brussels. Putin appeared to be betting that Europe would be too divided to act, and he was partly proved right. Europe agreed to freeze the reserves but the EU has failed to agree to take the next step and seize the reserves to use them for Ukraine. Now we have a middling solution — a loan to Ukraine backed by interest payments from the reserves — but it’s not enough.

Vladimir Putin and Russian Central Bank Governor Elvira Nabiullina

Putin had the advantage of having a very technically competent central banker, Elvira Nabiullina, who right from the start of the war imposed capital controls and hiked interest rates dramatically to stabilize the ruble. I think if there’s one person who helped Putin the most to counter the effect of sanctions and maintain his ability to keep the war going, it’s her — despite what my Bloomberg colleagues have reported about her personal misgivings about all of it.

If there’s one person who helped Putin the most to maintain his ability to keep the war going, it’s Elvira Nabiullina

How has the Russian elite responded to its isolation from the West? Have sanctions incentivized them to rally around the Kremlin?

The Russian elite is deeply unhappy with being sanctioned. With their assets frozen in the West, the billionaires sought to safeguard their Russian assets, which were of course at risk of being seized by the Kremlin if they directly criticized Putin. In my book, I delve into the UK sanctions against Oleg Tinkov, which remained in place for more than a year after he came out vociferously criticizing Putin for the invasion. As a result, he lost the bulk of his fortune in Russia. Let’s be clear: sanctioned Russians who stayed silent on the war made a choice, which was to hold on to their Russian assets. They could have funded the Ukrainian defense. They didn’t.

How much of the elite’s capital has been «trapped» inside Russia, and how significant is that capital for the domestic Russian economy?

The amount invested domestically as a result of sanctions has been relatively small compared to the amount of foreign investment that was withdrawn or stopped. There were reports that the post-invasion construction boom was the result of sanctions trapping money inside Russia, but it was also fuelled by mortgages subsidized by the Bank of Russia, which have now been withdrawn. Western companies exiting Russia created opportunities for Russians to buy their assets, such as Vladimir Potanin’s purchase of Rosbank from Societe General in 2022. Steel billionaire Vladimir Lisin, who is not sanctioned by the UK, EU or U.S., recently spent a relatively small sum buying a Russian baby food producer, which looked like a purchase that wouldn’t put him in danger of being sanctioned. With interest rates at 21%, they can earn enormous profits from bank deposits. Nevertheless, the amount of money flowing out of Russia through Turkey and Dubai remains sizable.

The title of your book is “Punishing Putin.” But have sanctions affected Putin as much as they have other Russians? Do we run the risk of giving Putin a useful public relations tool domestically?

Sanctions are an imperfect tool. Some Russians living in the West and not sanctioned had their accounts in Europe and the UK shut because of banks over complying. Others trying to flee Putin’s mobilization had difficulty accessing their funds from abroad. As Mikhail Khodorkovsky told me for the book, that fed into Putin’s narrative that the West was against all Russians. Encouraging more capital flight would have been smart, but not easy while using a blunt instrument like sanctions. Despite the obstacles, roughly 1 million Russians did leave. I think it’s too easy to blame sanctions for the apparent willingness of many Russians to stay and rally around the Kremlin.