Prices in Russia are rising so quickly that even official statistics largely confirm the economic reality. In an attempt to curb inflation, the Russian Central Bank has repeatedly hiked the key interest rate, but this step alone has proven insufficient, as the amount of money in circulation is also increasing — fueling price growth and putting pressure on the ruble’s exchange rate. There are no signs that the Bank of Russia will take stricter control of the money supply, and other factors, particularly the Kremlin’s ongoing war in Ukraine, do nothing to foster economic stability. Inflation in December has been rising at rates that, if sustained, would amount to 29-30% annually, and although the Central Bank’s key rate currently stands at a record 21%, further increases are expected. Of course, some vested interests in Russia continue to benefit from the galloping price growth, but the longer the current situation persists, the more severe the eventual collapse will be.

Content

The key rate failed to deliver

Why are prices in Russia rising?

Why is there so much money in the economy?

December and the printing press

Inflation is political

This article was originally published in Russian on Dec. 12, 2024.

The key rate failed to deliver

In August, Russia’s annualized inflation rate came in at 9.05%, in September it was 8.63%, and in October it fell slightly to 8.54%. Price growth seemed to slow, but only minimally. By the end of November, however, even this gain was lost, with inflation reaching 8.88%. A reduction in inflation by half a percentage point does not correspond to a three-point hike in the key rate.

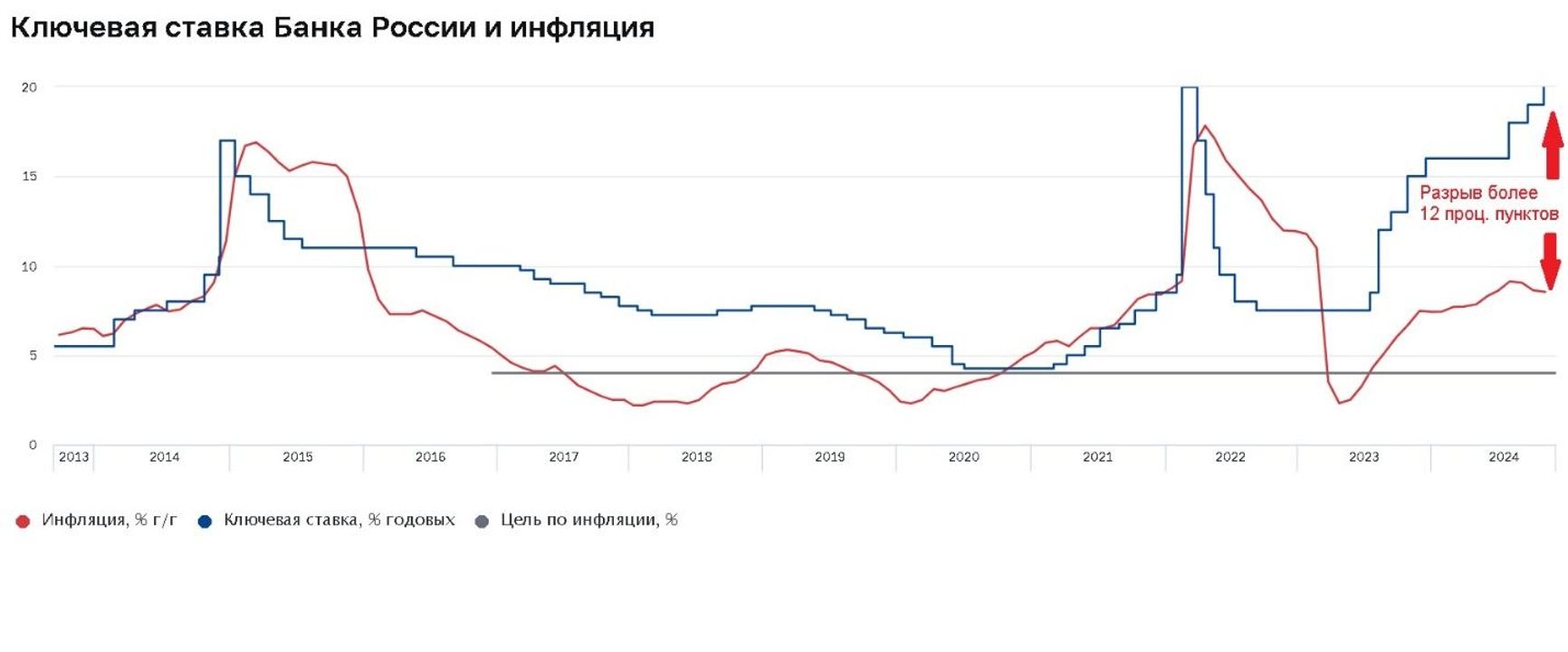

The gap between the key rate (21%) and the inflation rate (8.54%) has grown to 12 percentage points, which is exceptionally high. The Bank of Russia introduced the concept of a key rate in September 2013, and from that moment all the way up until February 2022, the key rate never exceeded the inflation rate by more than 5-6%. During the early stages of the full-scale war, the gap spiked to 11 percentage points for a month. Now, it is even larger, and it shows no sign of closing.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

Graph titled "Russian Central Bank's key interest rate and inflation." The red line indicates YoY inflation percentage, while the blue line indicates the key rate (in %). The grey line indicates the Central Bank's target inflation rate.

In the spring of 2023, official inflation rates remained below the 4% target, and in July, the Central Bank decided to raise the key rate from 7.5% to 8.5%. This measure was expected to bring inflation even lower. However, prices began to rise, and since then, the Bank of Russia has raised the rate seven more times. Despite these moves, inflation has doubled.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

The Bank of Russia has raised the rate seven times, which has not prevented inflation from doubling.

Annualized figures indicate that inflation, despite higher key rates, has accelerated from 6-7% to as high as 29-30%. In just the first two days of December, prices rose by 0.14% — the same rate as during an entire week in October. This rapid pace is partly due to seasonal factors: in November, inflation often accelerates as the fresh produce harvest comes to an end and pre-holiday consumer activity begins. Similar spikes were observed in 2023, when the consumer price index rose by 0.33% from Nov. 21-27. After adjusting for seasonal factors, today’s annual inflation rate in Russia is around 9%.

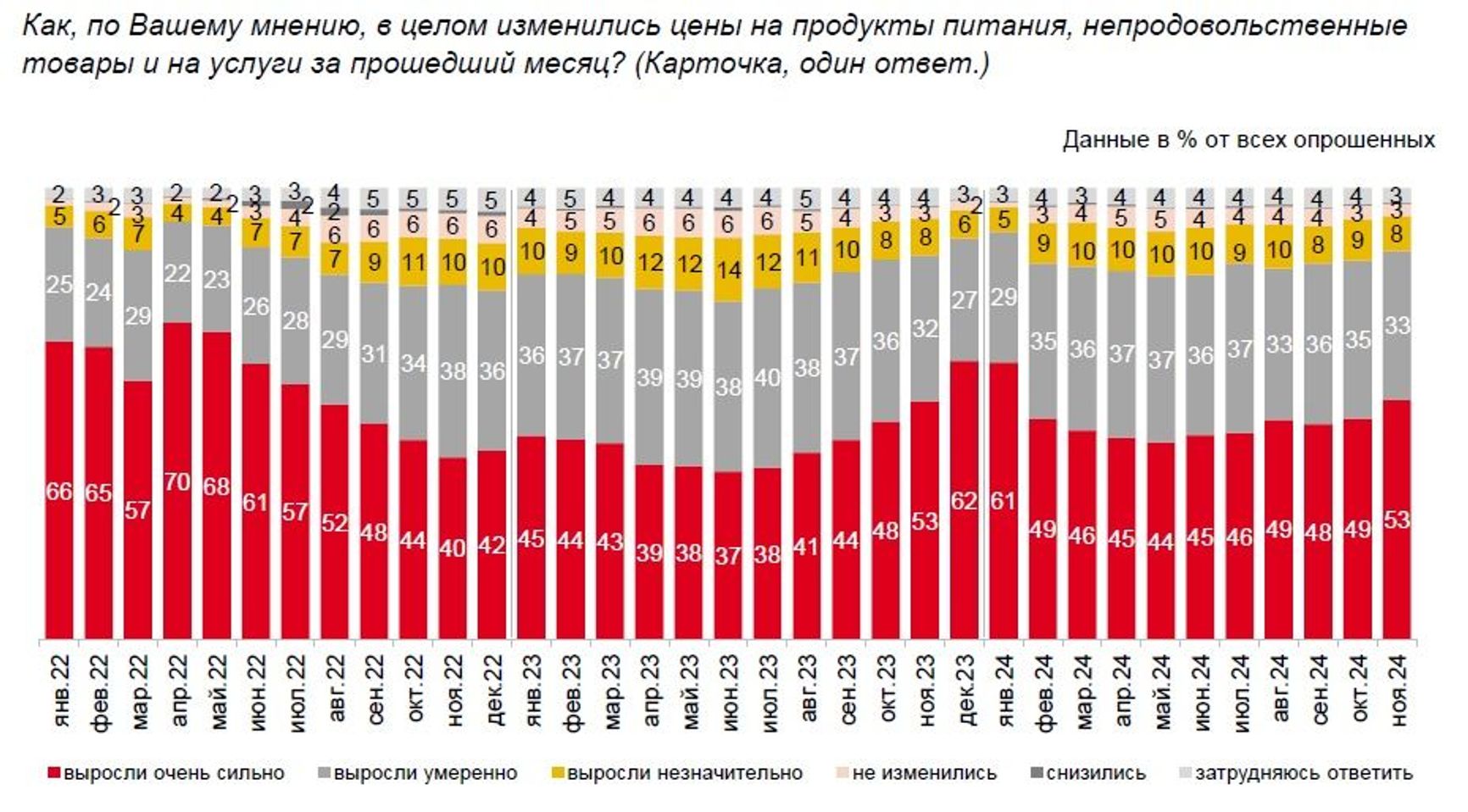

Surveys commissioned by the Central Bank indicate that people feel inflation just as sharply this November as they did a year ago: in both cases, 53% said prices had risen “very significantly.” Respondents perceive prices to be growing at an annual rate of 14-15% — a figure that has remained stable over the past few years and is nearly double the official statistic. Observed inflation has barely responded to hikes in the key rate.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

Survey results titled: “In your opinion, how have prices for food, non-food items, and services changed overall over the past month?” (Red: “rose very significantly”; gray: “rose moderately”; yellow: “rose slightly”; pink: “remained unchanged”)

Source: Bank of Russia

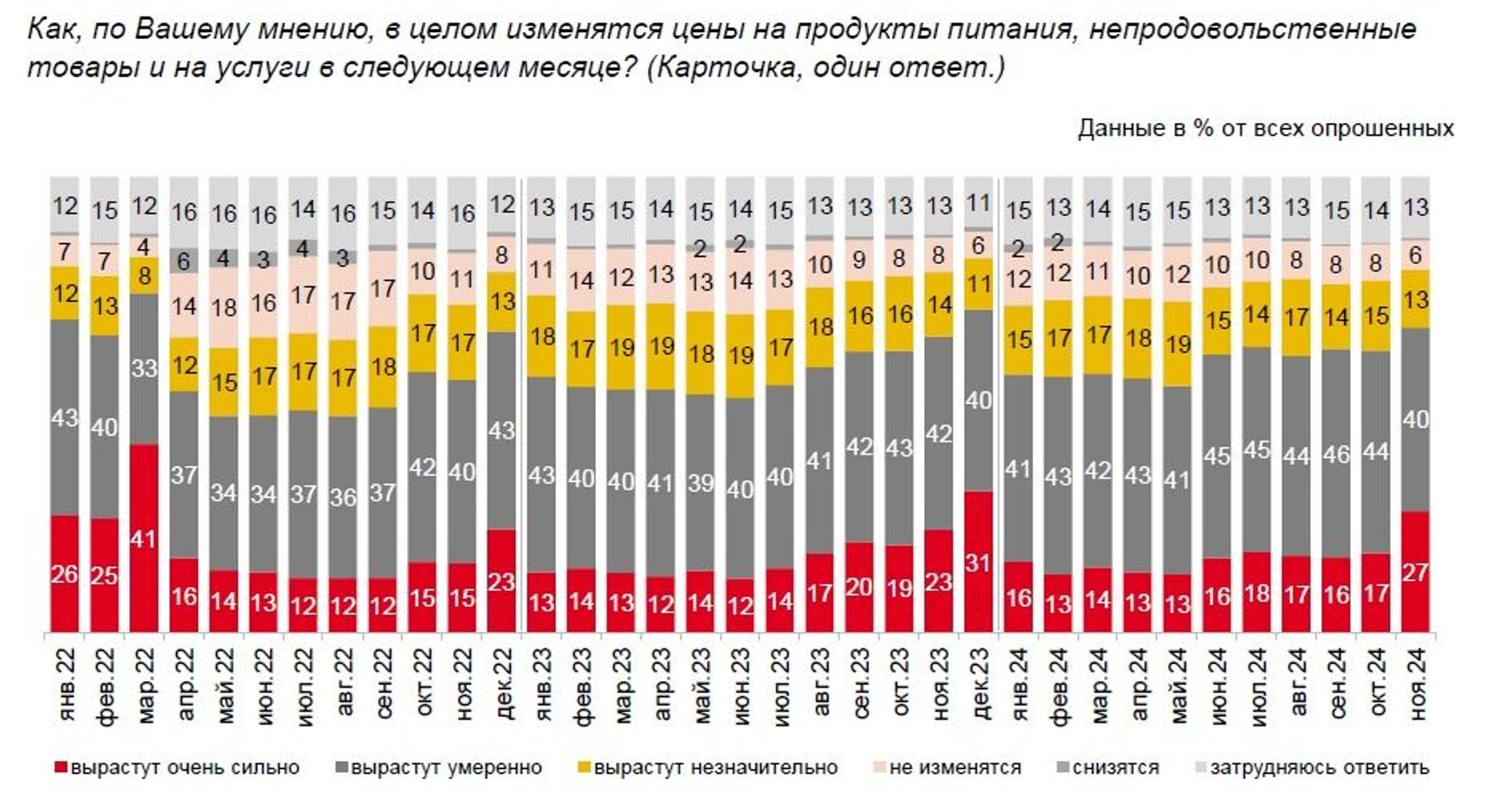

Consumer expectations regarding prices are now gloomier than they were a year ago: in the same November 2024 survey, 27% said prices would “rise very significantly” in the next month, compared to 23% in 2023.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

Survey results titled: “In your opinion, how will prices for food, non-food items, and services change overall next month?” (Red: “will rise very significantly”; gray: “will rise moderately”; yellow: “will rise slightly”; pink: “will remain unchanged”)

Source: Bank of Russia

By all measurements and assessments, inflation in Russia has not been effectively suppressed. One effect has been the weakening of the ruble. In December, its value fell to levels last seen on March 11, 2022, when the Russian currency was at its weakest in history: 120 rubles per U.S. dollar and 133 rubles per euro.

However, the Bank of Russia managed to halt the ruble's decline with a familiar brute-force tactic — announcing that it would temporarily halt purchases of foreign currency. The Central Bank is required to “mirror” the Ministry of Finance’s operations, meaning that when the treasury needs to buy rubles, the Central Bank buys foreign currency. However, to support the ruble’s exchange rate, the Central Bank has pledged to refrain from these purchases through Dec. 31.

Why are prices in Russia rising?

In most cases, a national currency devalues because the government cannot or does not want to live within its means. It spends far more than it earns, covering the difference by borrowing from the Central Bank, leading to massive money issuance. As a result, prices rise, and foreign currencies become more expensive.

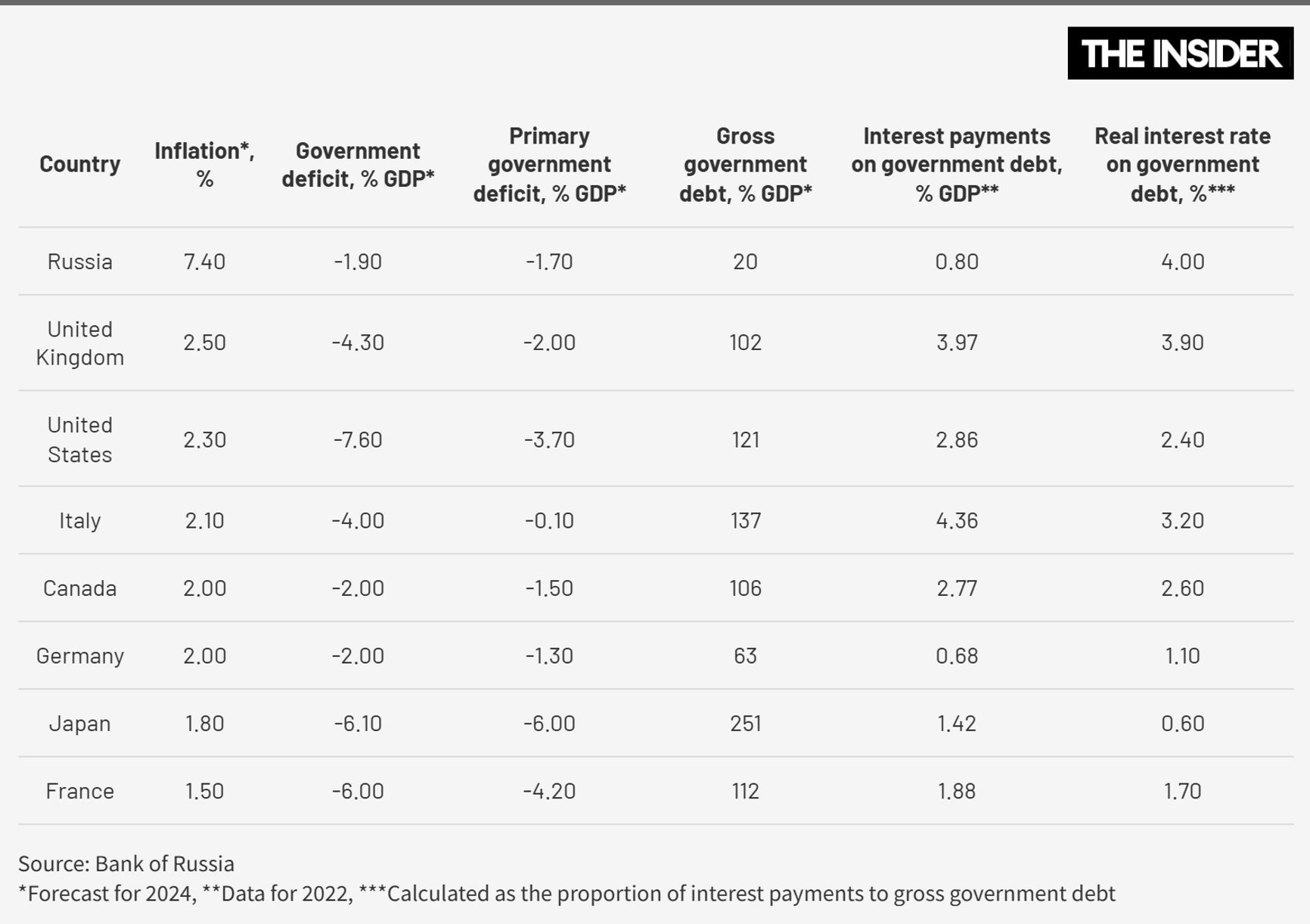

However, this is not the case in today’s Russia. According to the latest IMF estimates, Russia’s budget deficit in 2024 will be less than 2% of GDP — lower than that of any G7 country.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

Russia also has a relatively low public debt compared to GDP — only 20%, again far lower than in any G7 member. At the same time, the Russian government pays a relatively high interest on its debt — 4% annually in real terms. However, even this figure is far below the crisis levels of the 1990s, when it was several or even dozens of times higher.

What, then, is causing Russia’s inflation? The ruble money supply (commonly referred to as M2) is growing rapidly — by 20% year-on-year from November to November, according to the Central Bank, increasing from 91 trillion to 109 trillion rubles. The growth rate of the money supply is a fundamental benchmark for inflation forecasts. If the amount of rubles in the economy grows by 20% in a year, there is little need to look for other causes of inflation. It is more appropriate to question why price growth is so moderate — only 8-9%.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

If the amount of rubles in the economy grows by 20% in a year, there is little need to look for other causes of inflation.

The Central Bank itself acknowledges this issue. “It is commonly believed that inflation in Russia under current conditions is purely non-monetary. However, it is sufficient to observe the growth rates of the money supply in the economy (M2 or M2X) to conclude that elevated inflation is the result of monetary factors,” the regulator wrote in its December bulletin. This elevated price growth, the Central Bank continues, leads to higher production costs. “The latter is often presented as a result of non-monetary factors,” although the causes are frequently “monetary in nature.”

Why is there so much money in the economy?

The money supply is the product of two components: the amount of cash (monetary base) and how banks multiply that money (economists call this the “multiplier”). The Central Bank directly determines the first component, while it influences the second indirectly through banking regulations. The multiplier can change sharply and unpredictably depending on a variety of factors.

For example, during a crisis or financial panic, when people withdraw their money from banks, the multiplier decreases. In contrast, it grows during periods of euphoria and speculative frenzy. Simply put, when money is created from nothing, one part of these new sums is created by the Central Bank, and the other by commercial banks. When a bank issues a loan, the principal amount isn’t transferred from anywhere, but is merely added to the borrower’s account balance. The volume of such credit issuance depends both on market sentiment and Central Bank policies.

When the money supply grows, it’s important to identify which of the two factors is contributing the most. In Russia, from November to November, the monetary base increased by almost 14%, and the multiplier by 5%. This indicates that Russia's high inflation is primarily driven by the growth of the part of the money supply directly controlled by the Central Bank. However, banks and borrowers have also significantly contributed to the inflationary expansion.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

Russia's high inflation is primarily driven by the growth of the part of the money supply directly controlled by the Central Bank.

Russian companies are confidently borrowing money from banks at substantial interest rates. Some likely believe that inflation will devalue all their debts, while others rely on government contracts, subsidies, or increased demand in the real sector. According to official data, the real sector in Russia is growing. However, this illusion, vital for government propaganda, exacerbates the problem. In reality, a significant part of the real sector is stagnating but continues to fuel an unwarranted credit boom. As a result, both the money supply and debt levels see an increase. Eventually, creditors or borrowers will face a harsh awakening.

Further inflationary acceleration is dangerous for creditors, while harsh suppression of inflation is risky for reckless borrowers. The longer the current paradoxical situation persists, the more severe the eventual shock will be. “Through the credit and budget channels (financing the budget deficit), much more money is entering the economy than it can 'digest,'” the Central Bank acknowledges.

The Bank of Russia would like to suppress inflation as quickly as possible — at any cost. However, Putin will not commend Central Bank Governor Elvira Nabiullina if borrowers suddenly realize — en masse — that their prospects are bleak. As a result, the Central Bank’s policy remains a delicate and unstable compromise: attempts are made to slow credit growth, but very cautiously. In practice, no real deceleration occurs. Over the past year, Russian banks' loan portfolios have grown by 21%, funds on accounts with the Central Bank have increased by 56%, and total assets have risen by 28%. In effect, the monetary injection continues unabated.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

Putin will not commend Central Bank head Elvira Nabiullina if Russian borrowers suddenly realize — en masse — that their prospects are bleak.

December and the printing press

Has this trend changed in the fall, following two sharp key rate hikes? Yes, but not by enough. From August 1 to November 1, the ruble monetary base in Russia grew by only 1%, the multiplier increased by 3.4%, and the money supply rose by 4.4%. This is indeed a significant slowdown, but it remains insufficiently strict.

As also occurred in 2023, this year’s efforts have limited the growth of inflation without bringing it back down to manageable levels. And of course, the most freewheeling period of monetary issuance in Russia traditionally occurs in December, when the authorities urgently “create” money. In December 2023, the money supply increased by 6.3%; in 2022, by 7.2%; and similar trends were common in pre-war years. Regarding the monetary base, its December growth was 6.2% in 2023 and 14.2% in 2022. Without moderate or zero issuance in December, the government cannot claim that it is taking serious measures to curb inflation.

The proper question is why inflation in 2024 is only 8–9% — instead of 20%. There are two possible explanations:

- The growth in the money supply has been partially offset by an increased demand for money. Despite complaining about inflation, Russians continue to grow their bank deposit balances rather than withdrawing them or buying up foreign currencies in cash, as was common in the 1990s. Inflation remains relatively moderate, and legal banking transactions are convenient, so people are willing to endure for now.

- Actual inflation in Russia may be significantly higher than the 8–9% level. The “observed” inflation rate reported by survey respondents — 14–15% annually — may in fact be much closer to reality.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

Despite complaining about inflation, Russians continue to grow their bank deposits.

Inflation is political

Inflation everywhere is almost always the result of political decisions, and modern Russia is no exception. According to IMF data, many developing countries currently boast inflation rates below 5%. The list includes Uganda, Rwanda, Bhutan, Cameroon, Guatemala, and Honduras. In El Salvador, Cambodia, Senegal, and Burkina Faso, inflation is even below 3%. In Ukraine, despite all its challenges, inflation is lower than in Russia — 5.8%.

Zero price growth can even occur during a devastating war provided that the budget deficit and public debt are well-managed — as they are in Russia. However, even if those conditions are achieved, halting price growth also requires enduring bankruptcies, reduced consumption, and other similar outcomes. As a result, the Russian authorities prefer to mask the country’s problems — and inflation serves this purpose well.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.

Zero price growth can even occur during a devastating war, but this requires preparing for bankruptcies and reduced consumption. The Russian authorities prefer to mask the country’s problems using inflation

In short, raising the key interest rate does bring price growth under control when accompanied by rapid money supply growth. This is precisely what is happening in Russia, which is why the tightening of anti-inflationary policy under Elvira Nabiullina is entirely insufficient to halt price increases. But the situation may be changing. The Central Bank itself expects the money supply to grow more slowly in 2025, a development that should be facilitated by a slowdown in lending, signs of which are already visible. There are also plans to return to the budget rule in the coming new year.

The inflationary expansion of the banking sector in Russia's stagnating economy benefits many, but these gains are short-lived. In the long term, price stabilization would benefit all Russians. However, such an aim is not part of Putin’s political-economic framework, which operates on its own logic — and not for the overall benefit of the country’s citizens.

The M2 money supply is the total amount of all cash in circulation and non-cash funds in accounts. As of Dec. 1, 2024, it amounts to 111.1 trillion rubles.

M2X, the so-called “broad money supply,” includes not only M2 but also foreign currency deposits of Russian residents, amounting to 126.7 trillion rubles.